The financial journey of an aircraft involves a range of complex stages, requiring careful planning to ensure maximum value is achieved throughout its lifecycle. From the initial purchase to the final decommissioning, each step presents unique opportunities and challenges for both owners and operators. A thorough understanding of these stages is key to optimizing revenue and effectively managing expenses.

Acquisition: Setting the Stage

The financial journey begins with the acquisition phase, often representing one of the largest financial commitments in an aircraft’s lifecycle. Whether opting for a new or pre-owned model, the upfront cost is a major consideration. To ease the financial burden, financing or leasing options are available, but these come with their own set of challenges, including interest rates and long-term financial obligations. Additional costs, such as pre-purchase inspections and regulatory certifications, ensure the aircraft is both compliant and ready for operation.

Operators must decide between outright ownership and leasing. Full ownership offers control and long-term value, while leasing provides flexibility, which can be especially valuable for businesses that must adapt to shifting market conditions or technological innovations.

Operational Phase: Driving Revenue

Once an aircraft is in operation, it becomes an essential asset for generating income. Airlines and operators rely on passenger services, cargo transport, and charter flights to generate revenue. However, these earnings must offset substantial operational costs, including fuel, maintenance, crew salaries, and airport fees. Maintaining profitability in a competitive market depends on factors like effective route planning, fuel efficiency, and high aircraft utilization.

Ongoing maintenance plays a crucial role in this phase, ensuring safety and regulatory compliance. Predictive maintenance, empowered by advanced analytics, has transformed fleet management by helping operators detect potential issues before they become costly problems, thereby reducing downtime and unexpected expenses.

Mid-Lifecycle: Managing Downtime

Aircraft are not always in constant service, especially during market slowdowns or seasonal demand shifts. In such instances, storage presents an affordable alternative. Proper storage not only preserves the aircraft’s value but also ensures it remains a viable asset for future resale, leasing, or even repurposing (such as converting it into a freighter). Routine maintenance during storage is vital to keep the aircraft airworthy and safeguard its future profitability.

End-of-Life: Extracting Maximum Value

As an aircraft approaches the end of its operational life, owners can extract remaining value through resale, parts harvesting, or recycling. Refurbishing older aircraft for secondary markets can extend their serviceability, while valuable components like engines and avionics remain sought after in the used parts industry. Additionally, recycling materials such as aluminum contributes to sustainability efforts and generates financial returns.

The financial lifecycle of an aircraft is a dynamic process that requires strategic decision-making at every step. Choices made during acquisition, operation, storage, and retirement directly impact overall profitability. Integrated aviation services can play a pivotal role in guiding owners and operators through these stages, providing expert support and ensuring well-informed, financially sound decisions.

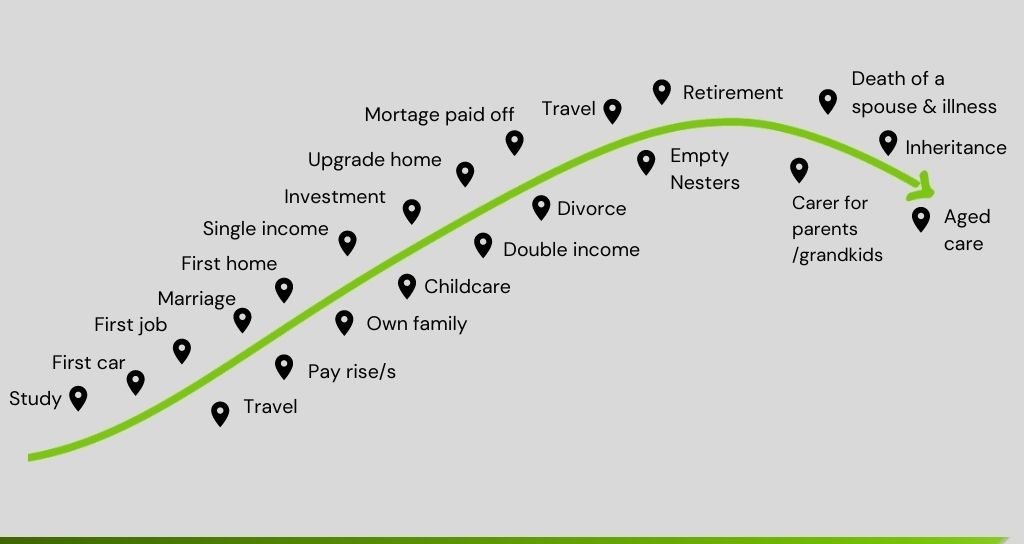

For more detailed insights into the financial lifecycle of an aircraft, please refer to the accompanying graphic resource.