Governance, Risk, and Compliance (GRC) platforms are essential for maintaining corporate integrity, managing risk effectively, and ensuring compliance with laws and regulations. With numerous GRC platforms available in the market, each offering a suite of features, deciding which is best suited for an organization can be complex. This article offers a comprehensive comparison of top GRC platforms, examining their features, benefits, and integration capabilities to aid in selecting the most suitable option.

Features of Leading GRC Platforms

Risk Management

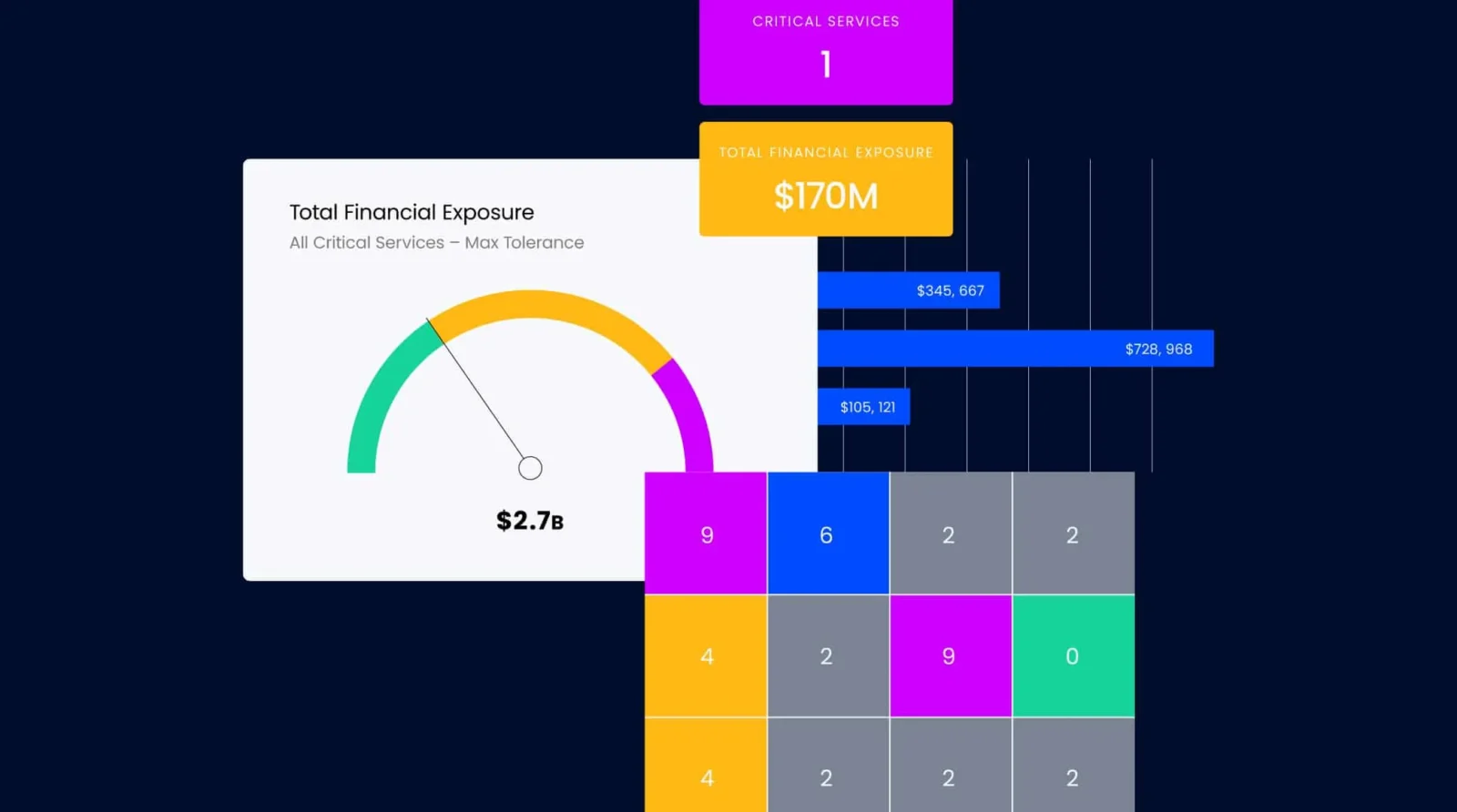

Top GRC platforms provide extensive tools for risk identification, assessment, and mitigation. Features like risk heat maps and automated risk alerts help organizations to prioritize risks and plan their mitigation strategies effectively.

Compliance Management

These platforms support compliance with multiple regulations, including GDPR, HIPAA, and SOX, among others. They often offer tailored solutions for different industries, ensuring that all relevant regulatory requirements are met.

Audit Management

Effective GRC platforms include robust audit management tools that streamline the audit process from planning to execution and reporting. This not only simplifies compliance audits but also provides insights into operational efficiencies and areas for improvement.

Policy Management

Managing and updating policies across an organization is simplified with GRC platforms. They enable centralized control over policy distribution, acknowledgment, and revision, ensuring alignment with internal standards and external regulations.

Benefits of Implementing a GRC Platform

Enhanced Decision-Making

By centralizing risk and compliance data, GRC platforms provide a holistic view of the governance landscape. This information aids in strategic decision-making, allowing organizations to respond proactively to potential risks.

Improved Efficiency

Automation features reduce the manual workload associated with compliance and risk management processes. This not only speeds up operations but also helps to eliminate human errors, leading to more accurate and reliable outcomes.

Regulatory Compliance

GRC platforms keep track of the latest regulatory changes and automatically update compliance processes. This continuous compliance monitoring helps organizations avoid fines and penalties associated with non-compliance.

Stakeholder Confidence

Using a robust GRC platform demonstrates a commitment to governance, risk management, and compliance. This helps to build trust among stakeholders, including investors, customers, and regulatory bodies.

Integration Capabilities

Integration is a key consideration when evaluating GRC platforms. Top systems offer seamless integration with a variety of other enterprise tools such as ERP systems, financial software, and HR platforms. This compatibility enables the aggregation of data across systems, enhancing visibility and control over enterprise risks and compliance.

Comparison of Popular GRC Platforms

- Platform A: Known for its superior risk management functionalities and AI-driven analytics. Ideal for industries with highly dynamic risk profiles.

- Platform B: Offers robust compliance management tools and is praised for its comprehensive regulatory content library. Best suited for organizations in heavily regulated industries.

- Platform C: Features an intuitive user interface and extensive integration capabilities, making it a good option for organizations with complex IT landscapes.

Choosing the right GRC platform requires a clear understanding of an organization’s specific needs and challenges. By comparing the features, benefits, and integration capabilities of various top GRC platforms, organizations can make informed decisions that align with their strategic goals and enhance their governance, risk management, and compliance efforts. This not only ensures regulatory compliance and risk mitigation but also drives overall operational efficiency and stakeholder confidence.